Mobile Money Expands Financial Access to Health Services

Categories: Announcements, Digital Finance

The term mobile money describes financial transactions that are conducted using a mobile phone where value is stored virtually (e-money) in an account associated with a SIM card. Such transactions are compatible with basic phones and do not require Internet access. In many countries, mobile money can be used to pay for health services and pay health workers’ salaries, enable health savings accounts, and facilitate conditional cash transfers and pay-for-performance schemes.

With over 3.2 billion individual subscribers, mobile phones are one of the fastest-spreading technologies in the world. Mobile money systems have the potential to extend the reach of financial services to populations not served by the traditional banking sector. In sub-Saharan Africa, for example, 12 percent of the population without a formal bank account uses mobile phones to conduct financial transactions1, and in at least 28 countries around the world, there are more mobile money agent outlets than formal bank branches2.

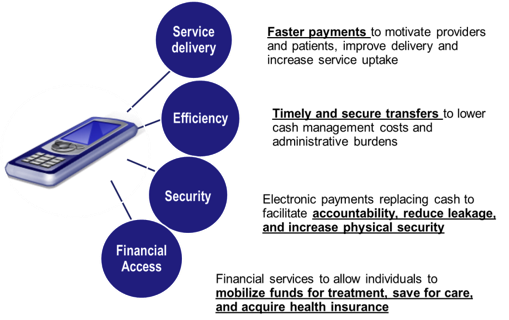

The Health Finance and Governance (HFG) Project is promoting the use of mobile phone-based payment solutions to expand the reach of priority health services to vulnerable populations, including women, girls, and the poor. Mobile money payment platforms can be leveraged to strengthen health systems by:

- Expanding Access. Financial services allow individuals to mobilize funds for treatment, save money for care, and acquire health insurance.

- Improving Service Delivery. Faster payments motivate providers to improve delivery and patients to increase service uptake.

- Increasing Efficiency. Timely and secure transfers reduce cash management costs, logistical constraints, and administrative burdens.

- Enhancing Security. Electronic payments facilitate accountability, reduce leakage, and increase physical security.

Through innovative programming, mobile money can increase the transparency, efficiency, and security of financial transactions at numerous points in the health sector. Mobile money also offers easily-accessed and traceable audit trails, which can increase transparency and improve governance in the financing flows of a health system.

HFG is supporting the transition to mobile money in the health sector by: developing and reviewing country strategies for integrating mobile money solutions; identifying resources and partners; collaboratively developing scopes of work for tailored country solutions; providing technical support in program design; and sharing information and best practices through country and regional-level workshops. To learn more please contact: Marty Makinen ([email protected])

1. Demirguc-Kunt and L. Klapper. 2012. “Measuring Financial Inclusion: The Global Findex Database.” Policy Research Working Paper 6025, World Bank, Washington, DC.↩

2. Claire Penicaud. GSMA – Mobile Money for the Unbanked. State of the Industry: Results from the 2012 Global Mobile Money Adoption Survey.↩